Despite recession fears and stock market jitters, construction demand and activity have held steady this year with backlogs dipping only slightly in most areas of the U.S. In fact, employment has remained strong with wages rising to their highest in the last decade, according to the Bureau of Labor Statistics.

Odds are your construction business may be busier than ever. If your team is growing, it’s a great time to add new estimating software or equipment before the end of 2019. Thanks to the nearly two-year-old Tax Cuts and Jobs Act (TCJA), small- to medium-sized contractors can again deduct up to $1 million on the purchase of new software or equipment before the end of 2019 under Section 179.

Deduction Has Roots in Tax Relief

Not surprising, this deduction has fluctuated since it was first introduced in 2008 as part of a stimulus plan designed to provide tax relief to small businesses. In 2018, Congress opted to double-down and increase the previous $500,000 deduction to $1 million.

Why is this important? Now, construction businesses can write off the entire costs of purchase in the year it is purchased. As long as the software or equipment is bought and put into service by December 31, 2019, it can be taken as a tax deduction. This includes things like software, office furniture, printers, and other devices.

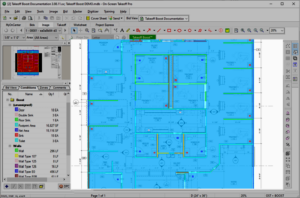

As a result, many construction businesses will consider taking advantage of Section 179 and make year-end purchases on tangible property like off-the-shelf estimating software.

Read the Fine Print

One of the many advantages of Section 179 is that—unlike with regular depreciation—you don’t have to reduce your deduction if you make qualifying purchases late in the year.

Ready to trim your tax bill? Here are a few more facts to note about Section 179 deduction:

- You can only write off the amount that you spend on qualified purchases. Spend $1 million and deduct $1 million. Spend $10,000, write off $10,000.

- The “phase-out threshold” is $2.5 million. This means a business can spend up to that amount in total equipment before the $1 million limit begins to be reduced dollar for dollar.

- You can’t deduct more than your profit. If your business only has $100,000 in profits, you can only deduct $100,000.

- Your purchases like software must be used for business purchases more than 50% of the time to qualify for the deduction.

Understanding Bonus Depreciation

While Section 179 may seem straightforward, you should also know there is bonus depreciation, which was scheduled to drop from 50 percent in 2017 to 40 percent in 2018. It was increased to 100% for the 2018-2022 tax years.

What’s new? The main difference is that it now applies to both new and used equipment. This is a change from previous years where bonus depreciation only covered new equipment. Tax experts point out that bonus depreciation is helpful for larger businesses that spend more than the Section 179 spending cap of $2.5 million on new capital equipment.

Tax Break You Can Bank On

For many contractors, the bottom-line on Section 179 is that it allows them to write off an entire purchase in the first year and reduce their net income and trim taxes. Rather than having to spread out the deduction over a normal five-year depreciation schedule, you can continue to write off the entire cost in the year the purchase is made.

Let’s face it, a potential $1 million tax deduction is exciting. The win-win is that this deduction is specially designed to boost profits. By deducting the full cost of these expenses, you can substantially lower the amount paid for equipment or software.

Now that you know that investing in estimating software can save on your taxes, why not get started now with a free trial? It’s quick and easy to request a 14-day, risk-free trial. You’ll still have plenty of time to lock in your tax savings.

*This program does not assume your company will qualify to take advantage of IRS Section #179. Please consult your tax advisor or accountant for additional information. Software must be purchased and placed in service by 12/31/19.